oregon workers benefit fund tax rate

On July 1 2018 HB 2017 the Statewide Transit Tax STT went into effect which requires all employers to withhold report and remit one-tenth of one percent or 0001 of wages paid to employees. General Oregon payroll tax rate information.

Oregon Workers Compensation Division Order Compliance Poster Employer State Of Oregon

UI Trust Fund and Payroll Taxes FAQ.

. Oregons Self-Adjusting Tax Rate Schedules. 2021 Payroll tax rate. West Virginias House members have said they want to stabilize the trust fund but they have opposed Black Lung Association calls to increase the tax 25 from its pre-2022 levels in.

The second form is that should the fund reach a 90 funding level PERS would stop diverting the money until of course the fund dives below 90. 2021 UI Tax Relief fact sheet. Workers Comp Insurance Coverage From AmTrust.

The company has grown from 526 Million in 2006 to over 41 Billion in 2014. 653033 Schedule to increase certain subminimum wage rates for individuals with. UI Trust Fund fact sheet.

Basically the diversion is a correction for the monumentally stupid IAP plan created by. Sation paid by an eligible employer to agricultural workers on an hourly or piece-rate basis. Monday - Friday 800am - 500pm 1-800-332-2313 900 Court St.

653025 Minimum wage rate. 653027 Wage rate for persons under 18 years of age in agriculture. The STT is calculated based on the employees wages as defined in ORS 316162.

NE Salem Oregon 97301. Oregon State Legislature Building Hours. This is due to the tax formula used to fund it.

653026 Nonurban county defined for ORS 653025. Between 1990 and 2013 a period when the number of undocumented immigrants more than tripled the rate of violent crime in the US. State and local tax revenue is a major source of support for public colleges and universities.

If you want to fully fund your IAP you have the option to contribute your own after tax dollars to the IAP to make up for the diversion. But that rate increased on Jan. 5 And because they are ineligible for most federal benefits experts have long argued.

Fund administrative costs of the states workers compensation system noncomplying employer claims a portion of Oregon OSHA administrative costs and other related programs. Fell by 48 percent. See the Departments FAQs and fact sheet for more information on the 2021 rate schedule projection and go here for general information on how Oregon SUI tax rates are computed.

COVID-19 Interest and Penalty Relief Application. Revenue from the STT goes into the Statewide Transportation. Even after paying approximately 18 billion in regular unemployment insurance benefits since March Oregons Trust Fund which kept Oregon solvent through the Great Recession and is on track to remain solvent through the current recession is one of the healthiest in the nation.

Were hiring - apply today. Report employees not returning to work. 2021 Tax Rates and breakdown of changes for Oregon employers.

3 Instead of committing crimes the vast majority of undocumented immigrants in the country are working 4 and paying into our tax system. 1 to 6 of workers wages and. B A labor contractor licensed under ORS 658410 may not claim a credit under this.

653030 Commissioner may prescribe lower rates in certain cases. Unemployment Insurance Trust Fund and Payroll Taxes. 653022 Piece-rate-work-day defined for ORS 653020.

Oregon Transit Tax. AmTrust North America is one of the fastest growing insurance companies in the comp industry. When premiums started in 2019 04 of workers wages funded the program with 63 paid by employees and 37 paid by employers.

Unlike private institutions which rely more heavily on charitable donations and large endowments to help fund instruction public two- and four-year colleges rely heavily on state and local appropriations and dollars from tuition and fees. The Workers Benefit Fund WBF assessment This is an assessment on the payroll earned by all workers subject to Oregon workers. Contact the UI Tax Division.

The federal Treasury Direct website shows that despite having the highest Ui benefit claims in Oregons history Oregons UI trust fund balance was 3781391672 as of January 31 2021. Recruitment Services. The amount of the credit shall equal a percentage of the actual excess paid to agricultural workers during the tax year as determined under section 9 of this 2022 Act.

Online Payroll Reporting System.

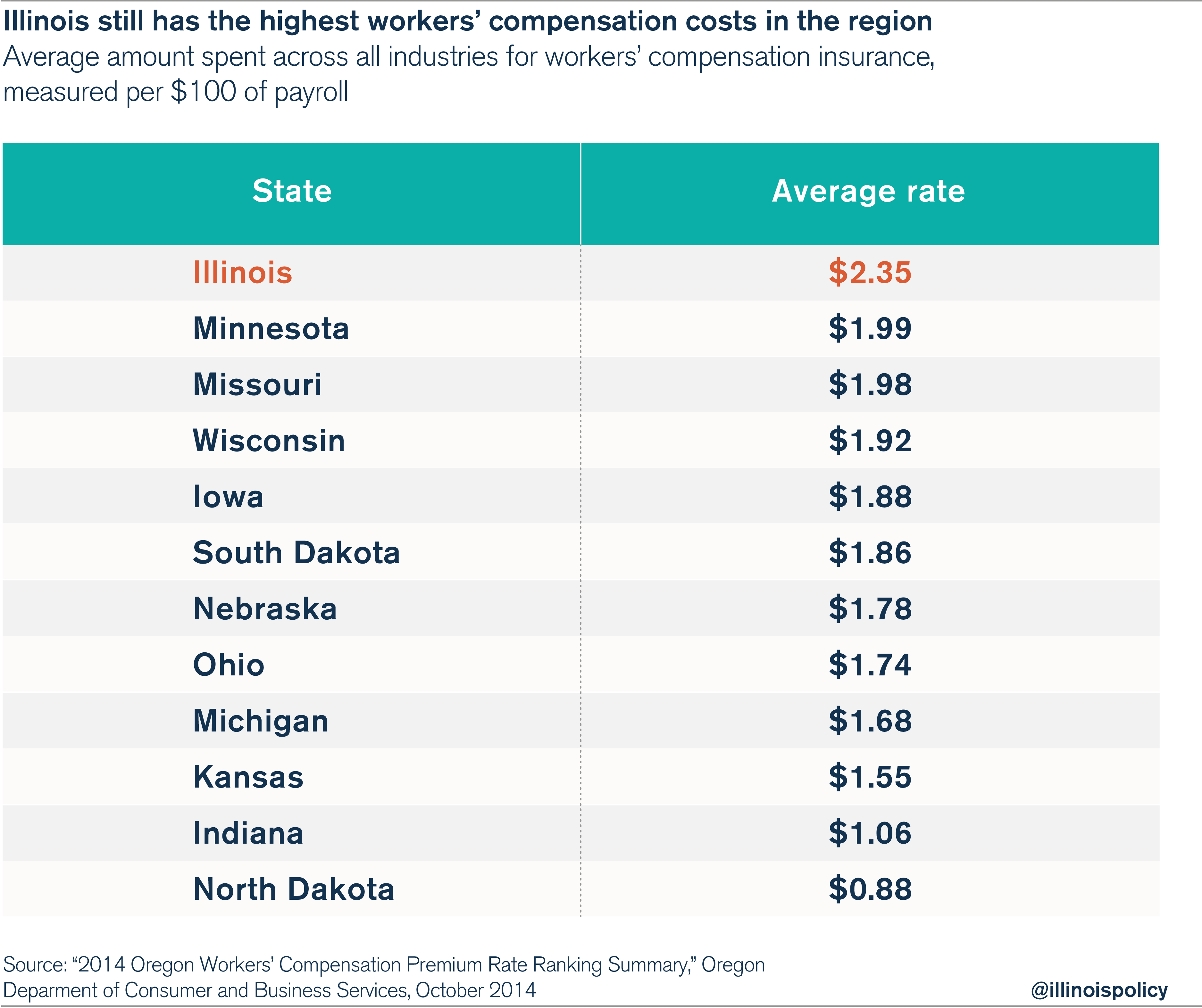

Illinois Still Has The Highest Workers Compensation Costs In The Region By Far

Oregon Workers Benefit Fund Wbf Assessment

Workers Compensation Overview And Issues Everycrsreport Com

Employee Age And Workers Compensation Utilization Amtrust Financial

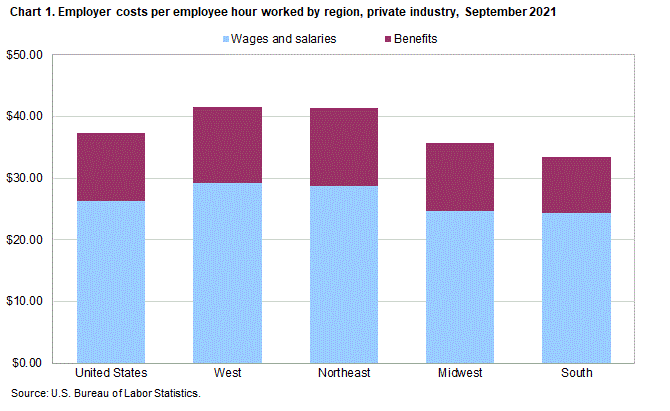

Employer Costs For Employee Compensation For The Regions September 2021 Southwest Information Office U S Bureau Of Labor Statistics

What Wages Are Subject To Workers Comp Hourly Inc

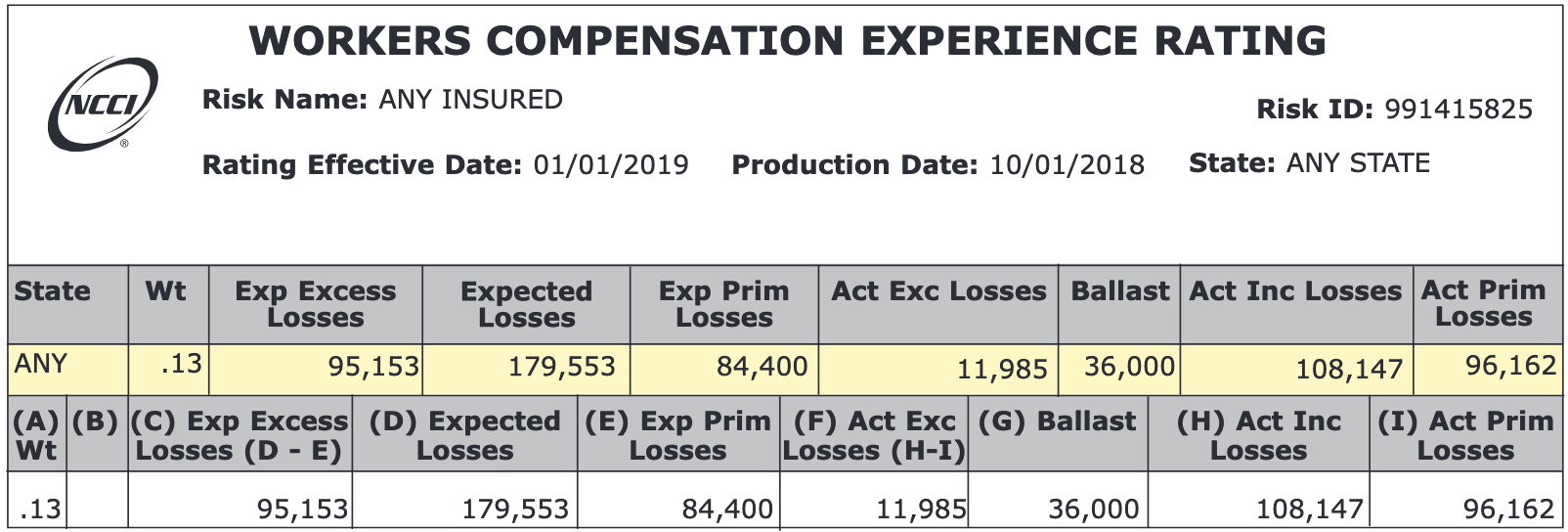

Understanding Your Workers Comp Ex Mod Factor Payroll Medics Payroll Workers Compensation Hr Solutions

Is Workers Comp Taxable Workers Comp Taxes

Payroll Reporting With Paypro Policyholder Center

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

Beware The State Of Your Workers Compensation Coverage Psa Insurance And Financial Services

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

How Do You Negotiate A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

Terminating An Employee On Workers Compensation Nsw Owen Hodge Lawyers