estate tax exemption sunset date

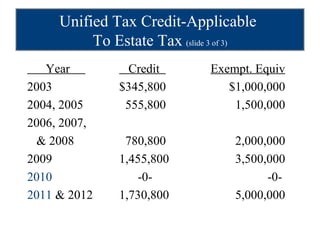

Estate and gift tax. In 2017 the exemptions were 5490000 for a single person and 10980000 for a married couple.

Recent Changes To Estate Tax Law What S New For 2019

3 Understanding the 2022 Estate Tax Exemption Given the size of the estate tax exemption the number.

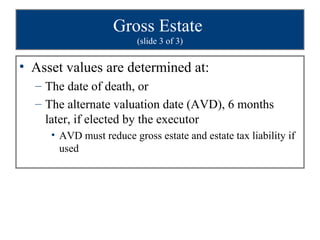

. Unless Congress changes the current law the higher estate and gift tax exemption will Sunset on December 31 2025. Regardless the unified lifetime exemption will continue to. Of 11700000 there would be zero tax due on the estate and a full step up in tax basis on all assets to the value on the decedents date of death.

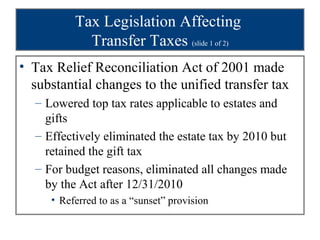

Its also important to remember that the law could be changed at any time before the sunset date-so its important to monitor it for changes. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation which means you can pass on approximately 6 million free of federal estate taxes.

January 1 2022 EstateGift Tax Exemption Cut in Half Currently the gift estate and GST tax exemptions are each 117 million per person for 2021. The first 1206 million of your estate is therefore exempt from taxation. Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available.

Key estate tax figures for 2022 Unified estate and gift tax exemption 1206 millionindividual Maximum tax rate 40 Annual gifting exemption 16000individual. The current estate tax exemption is set to sunset on January 1 2026 at which time the exemption will revert back to the 5 million level it was before the 2017 Act. In 2025 you both give zero to your heirs and you both die in 2026 with an estate of 23 million.

While the law may undergo additional changes between now and January 1 2026 currently the only way. Learn all about Sunset Valley real estate tax. Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information.

Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less and you were to die in 2022. This means that if Congress does not take action before then federal gift and estate tax law will generally revert to rules in place in 2017. TCJA doubled the estate and gift tax exemption to 112 million for single filers 224 million for couples and continued to index the exemption levels for inflation.

Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to. Starting January 1 2026 the exemption will return. Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025.

Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider. You may recall that the 2017 Republican tax reform legislation roughly doubled the estate and gift tax exemption. The estate tax exemption is a whopping 234 million per couple in 2021.

Under current law this exemption is planned to sunset to 5 million adjusted for inflation on January 1 2026. The federal estate tax goes into effect for estates valued at 117 million and up in 2021. And estate taxes will sunset after 2025.

The federal estate gift. The 2022 exemption is 1206 million up from 117 million in 2021. Federal Estate Tax.

For many boomers the sunset of the current estate and gift tax provisions provides the greatest gloom. We arent sure what you will be living on between 2025 and the date of your death but at least no death tax will be payable. However on January 1 2026 the TCJA provisions related to federal gift estate and GST exemptions sunset and revert to 2017 levels with inflationary increases.

This means starting in 2019 people are permitted to pass on tax-free 114 million from their estate and gifts they give before their death. ARB of that planned meeting no less than 15 days in advance including place date time or in lieu of an in. Dont be complacent about the current 2026 sunset date of the GST tax exemption amounts writes contributor Alyse Reiser Comiter.

Importantly the current doubled base exemption value of 10000000 is slated to sunset meaning that it will revert to 5000000 effective January 1 2026 unless Congress acts to extend current law. The grantor of the trust has the flexibility to forgive the loan prior to the sunset date and complete the gift. The current exemption doubled under the Tax Cuts and Jobs Act TCJA is set to expire in 2026.

Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year. Paying estate taxes is quite painful for those who are fortunate to have estates large enough to get hit with the estate tax. The tax bill passed by the House and Senate yesterday temporarily doubles the exemption amount for estate gift and generation-skipping taxes from the 5 million base set in 2011 to a new 10.

The estate tax due would be zero. Because the exclusion amount is back to 115 million your estate tax is 46 million. This goes up to 1206 million in 2022.

2026 Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Couples can pass on twice that amount or 228 million. Whether you are already a resident or just considering moving to Sunset Valley to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

Nyc Real Estate Taxes Overview And Guide Hauseit New York City

Death Bed Estate Planning Fire Drill The Hayes Law Firm

Before Sunset Planning Under The Tax Cuts And Jobs Act Tcja

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

More Tax Exemption Proposed For Taxpayers Taking Care Of Their Elderly

Recent Changes To Estate Tax Law What S New For 2019

Estate Tax Law Changes Are On Hold For Now

Recent Changes To Estate Tax Law What S New For 2019

How Do Millionaires And Billionaires Avoid Estate Taxes

Estate Tax Law Changes Are On Hold For Now

What The Inheritance Tax Means For Step Families Njmoneyhelp Com

Potential Estate Planning Issues Under The Proposed For The 99 8 Percent Act Dean Mead